Coronavirus: the economic impact - 28 March 2020

17 June 2020 By the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

By the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

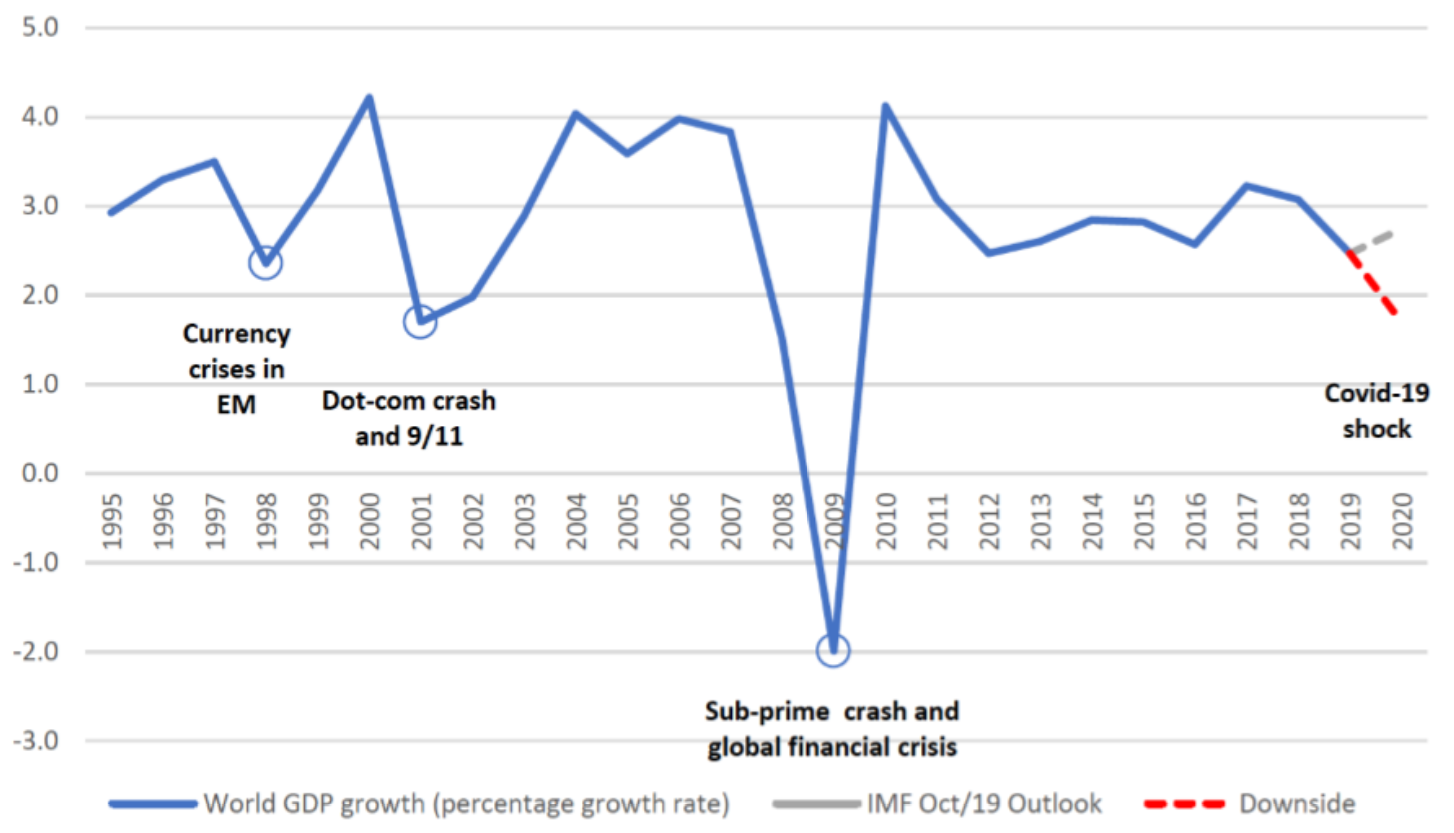

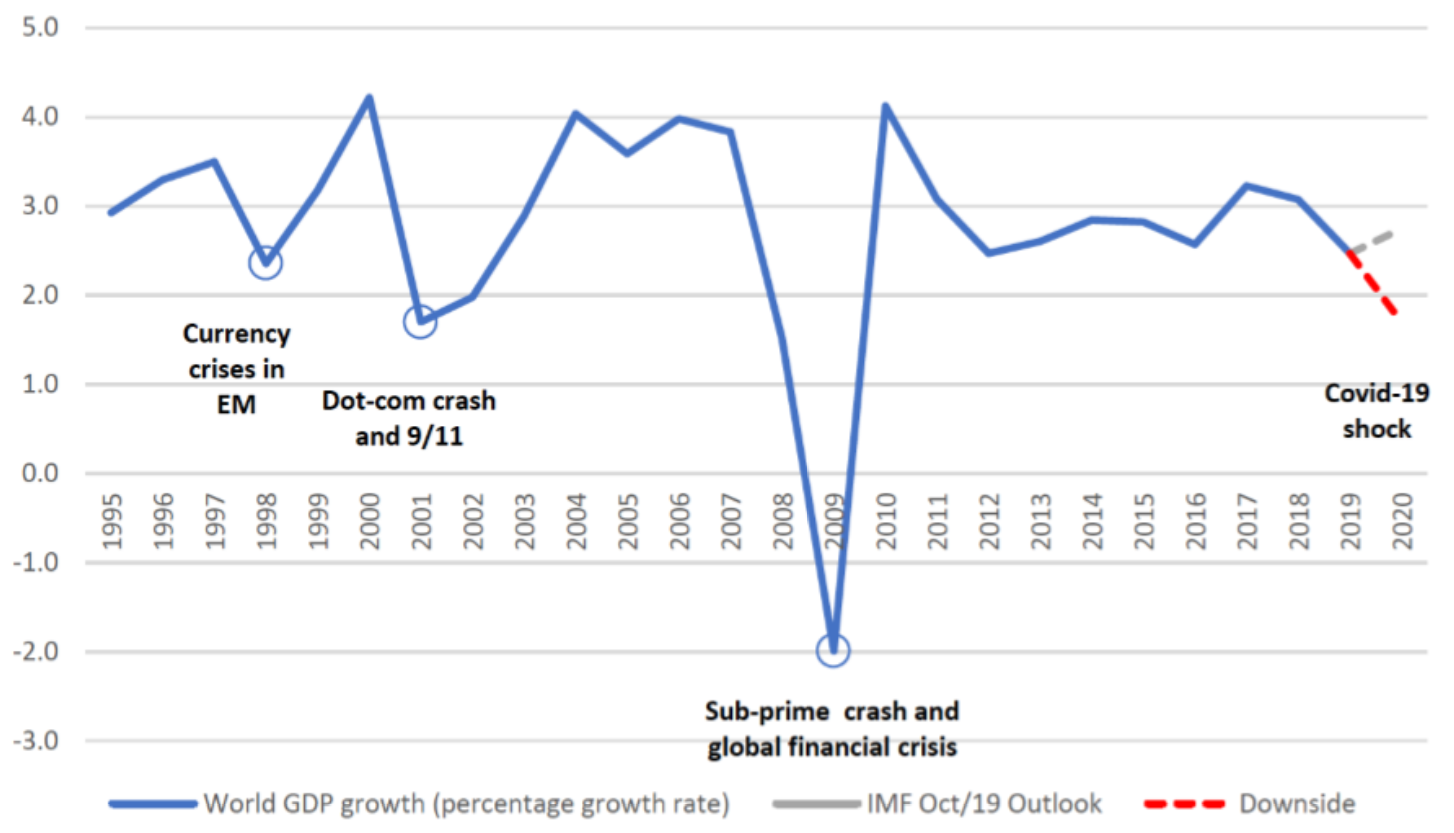

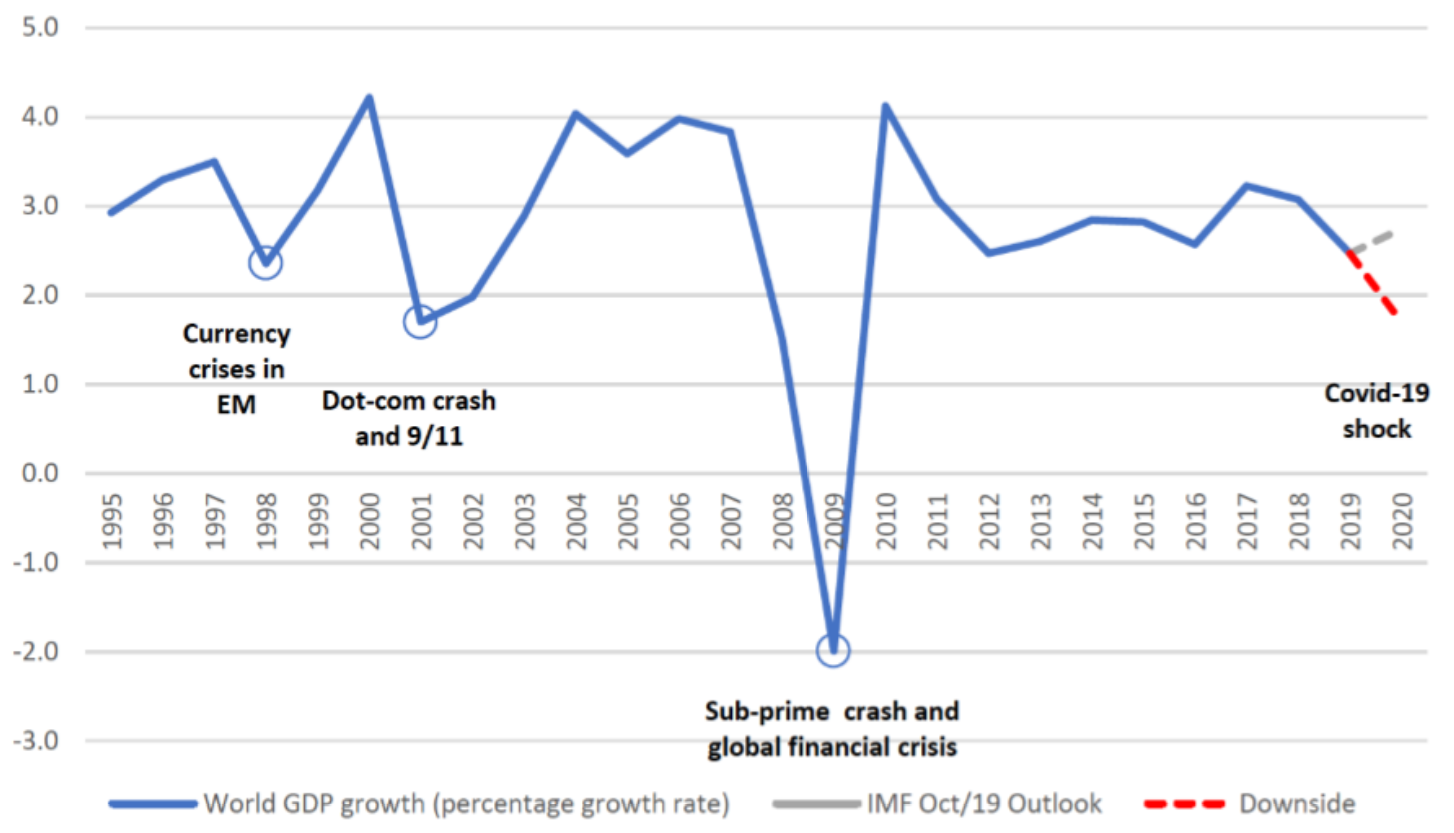

The coronavirus (COVID-19) outbreak has already led to a major health crisis in several countries and to major disruptions of the global economy. Yet the situation is likely to become even worse in the coming weeks and months, and the economic fallout from the pandemic might represent one of the biggest shocks of recent decades.

Global value chains (GVCs) have already come under pressure as a viable model for the organization of international production since the outbreak of the COVID-19 epidemic in China, and even more so since the virus turned into a global pandemic. Some analysts expect a major reshuffling of the global production network as a result of the pandemic, which was already triggered by the US-China trade war (CNBC, 2020).

UNIDO’s data on world manufacturing production

UNIDO’s data showed a consistent decline in production growth, indicating an overall economic slowdown already before the outbreak of the COVID-19 crisis. Manufacturing output growth fell below the landmark of 1 per cent and remained at 0.7 per cent in the fourth quarter of 2019 (UNIDO, 2019).

In the fourth quarter of 2019, only three industries registered a positive year-over-year growth rate in all country groups, namely basic pharmaceutical products, beverages and food products. While these three industries represent essential basic consumer goods and are likely to continue to perform well over the coming months, other manufacturing industries are expected to suffer a severe blow due to the coronavirus outbreak and the resulting economic implications. Consequently, world GDP growth can be expected to decline in the coming months.

Three main channels of the global economy will be disrupted: demand, supply, and finance

On the demand side, a combination of reduced income and fear of contagion will result in lower private spending. Although some of these effects might be offset by increased government spending, the COVID-19 shock’s net demand effect is expected to be negative in the short run.

This could be amplified by negative supply side effects, attributable to a sudden halt in manufacturing activities in the most affected regions and the resulting bottlenecks in global value chains. If left unaddressed, such disruptions will in turn trigger widespread factory closures due to the lack of intermediary inputs, even in areas less affected by the virus.

Lastly, increased risk aversion and a flight-to-liquidity in the face of uncertainty caused by the COVID-19 shock, the financial markets stress will weigh heavily on the global economy. Further fluctuations are expected in the foreign exchange market.

Substantial increase in unemployment

A substantial increase in global unemployment seems almost certain. The ILO expects the pandemic to disproportionally affect not only those workers with underlying health conditions, but also young people who are more vulnerable to decreased labour demand, women, who are over-represented in those sectors that are likely to be affected most (such as services or in occupations on the front lines of the pandemic, e.g. nurses), as well as unprotected workers in the so-called ‘gig economy’ and migrants. (ILO, 2020).

Capital flight

The pandemic has already triggered capital flight and a sharp reversal of international investment in emerging markets. Whereas a group of 24 emerging markets including China, India, South Africa and Brazil, had a net inflow of investments of US$79bn in 2019, US$70bn in investments had already exited those countries in the last two months alone according to the Institute of International Finance (New York Times, 2020). With this in mind, the decision by the G20 governments to “do whatever it takes” to minimize the social and economic fallout due to the coronavirus - and most importantly, to ensure cross-border flows of vital medical supplies, agricultural products and other goods and services – was welcomed (The Guardian, 2020).

Possibility of insolvency and default

This capital flight has reignited fears that countries such as Argentina, Turkey or South Africa, could be sliding toward insolvency and default soon. This could be further accelerated by currency depreciations in these countries. The Argentine peso continued to devalue and decreased by another 6 per cent against the dollar this year alone. Similarly, the Turkish lira has dropped by 10 per cent since January due to investors pulling out money and Turkish companies facing bankruptcy.

While these are only two examples, the situation is becoming equally dire in many other low- and middle-income countries and requires urgent attention from policymakers and the international community.

Significant contraction of FDI

The effect of the pandemic is similarly dramatic when we look at foreign direct investment (FDI). On 26 March, UNCTAD estimated a collapse of global FDI by - 30 per cent to - 40 per cent during 2020–2021, much more than the previous projections of -5 per cent to -15 per cent two weeks earlier.

While those countries most severely affected by COVID-19 will be hardest hit, other countries are also likely to feel the virus’s full impact as supply chain disruptions on investment prospects. Over two-thirds of the 100 multinational companies tracked by UNCTAD have issued statements on the effects the virus has had on their business. Many are reducing capital expenditure in affected areas, and to date, 41 have issued profit alerts. Lower profits translate into lower reinvested earnings, a major component of FDI.

A wider sample of the top 5,000 listed companies shows that the earnings forecasts for the fiscal year 2020 have been revised down by an average of 30 per cent. The hardest hit sectors are the energy and basic materials industries (-208 per cent for energy, with an additional shock caused by the recent drop in oil prices), airlines (-116 per cent) and the automotive industry (-47 per cent).

Trouble in global value chains and supply chain contagion

As outlined by Richard Baldwin and Eiichi Tomiura in their essay published on 6 March 2020, the hardest hit countries account for the majority of global GDP, manufacturing production and exports. Furthermore, the mitigation policies introduced will result in a global slowdown in aggregate demand. Global supply chains have fundamentally changed how supply shocks propagate. As industrial parts and components are increasingly traded, a supply shock in a globally integrated economy is likely to create ‘supply chain contagion’ via the trade in intermediate goods.

Baldwin and Tomiura develop different supply chain scenarios based on the WTO’s Global Value Chain Development Report 2019 and by citing case studies from The Economist. They also use data from the OECD Trade in Value Added database to quantify the importance of inter-linkages for different countries. The authors find a mixed picture for trade in services, as some industries such as tourism and air travel will be hit hard, while others, such as ICT and medical services, will not be as affected.

Impact on production and trade

According to reports by academics and practitioners on the impacts of the coronavirus, the virus implies both a demand and a supply shock.

The supply shock

From the supply side perspective, production is affected, on the one hand, because of reductions in labour supply as a consequence of the number of workers infected, thus reducing the number of people available to work, and because value chains are disrupted, on the other. Countries that rely on equipment and components from regions affected by the virus may experience disruptions in the production process.

The demand shock

Demand for manufactured goods could reduce as a consequence of the pandemic. This usually occurs for two reasons:

First, the propensity to consume decreases as workers who are required to stay at home in support of “social distancing” measures tend to prioritize saving over spending.

Second, firms that are experiencing disruptions in the production process may decrease their consumption of intermediate goods.

Supply and demand shocks can manifest in different ways across countries and different industries. The differences between various regions could be as follows:

Impact on manufacturing industries

The coronavirus is now rapidly spreading around the world. Anecdotal evidence is reporting losses for the manufacturing sector beyond China, namely also for many rich developed countries. According to IBIS World, relevant impacts are being registered in many countries such as Australia, Canada, Germany, New Zealand and the United States. Recurrent losses in these countries are reported in the domestic market, particularly in the food industry due to the closure of pubs, restaurants and other caterers.

Heavy losses are being registered on the international markets in the automotive industry (a huge decrease in sales of 82 per cent in Germany), and in high-tech industries such as computers and electronics, the traditional champions of revealed comparative advantage in rich countries.

Disclaimer: This brief provides information about a situation that is rapidly evolving. As the circumstances and impacts of the COVID-19 pandemic are continuously changing, the interpretation of the information presented here may also have to be adjusted in terms of relevance, accuracy and completeness. The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).