Latin America: Kickstarting manufacturing in the time of COVID-19

09 June 2020 Fernando Santiago and Fernando Vargas

Fernando Santiago, Industrial Policy Officer, UNIDO.

Fernando Vargas, Specialist in Competitiveness, Technology and Innovation, Inter-American Development Bank

The continued spread of COVID-19 through Latin America and the Caribbean shows no signs of abating. At the end of May, the region became the global epicentre of the pandemic amid a growing number of infections and deaths related to the SARs-coV-2 virus. Despite the fact that the virus remains at its peak, several economies across the region are debating a gradual reopening of activity in an attempt to limit economic damage from the pandemic. Manufacturing, already in the doldrums before the current crisis, is one of the sectors most affected by the shutdown of economic activity. What will it take to meet the challenge of reviving the sector and transform it into an engine of innovation and growth?

Declared the new epicentre of the pandemic at the end of May by the Pan-American Health Organization (PAHO), the WHO’s Americas branch, the region remains in the eye of the storm. As of 8 June, Brazil, with over 691,000 cases, has the second highest number of COVID-19 infections in the world and, together with Mexico, is among the 10 countries with the largest number of deaths (JHU 2020). In Ecuador, Chile and Peru, the rate of infection is still rising.

Beyond the severe social and health implications associated with COVID-19, the economic impacts are palpable. (ECLAC, 2020a, b). Lockdown measures and physical distancing, combined with the shutdown of economic activity, have disrupted trade and investment. On top of that, the closure of numerous businesses, which under normal conditions would be perfectly viable, threatens to raise the level of unemployment across the region. The overall impact on economic activity will be profound, with the most vulnerable, who largely lack adequate social protection, hit hardest.

The Economic Commission for Latin America and the Caribbean (ECLAC) forecasts that GDP will contract by 5.3 per cent in 2020, before recovering in 2021 when GDP growth is predicted to reach 3.4 per cent (FMI DataMapper). The loss of dynamism in its biggest economies, Brazil and Mexico, is a drag on growth prospects for the whole region. Both countries are heading for their worst crisis in recent history. In Mexico’s case, GDP is expected to contract by 8.8 per cent in 2020, followed by a recovery to 4.1 per cent in 2021, according to the Bank of Mexico. In Brazil, official estimates point to a fall of 4.7 per cent in 2020, with growth rebounding to 3.2 per cent in 2021.

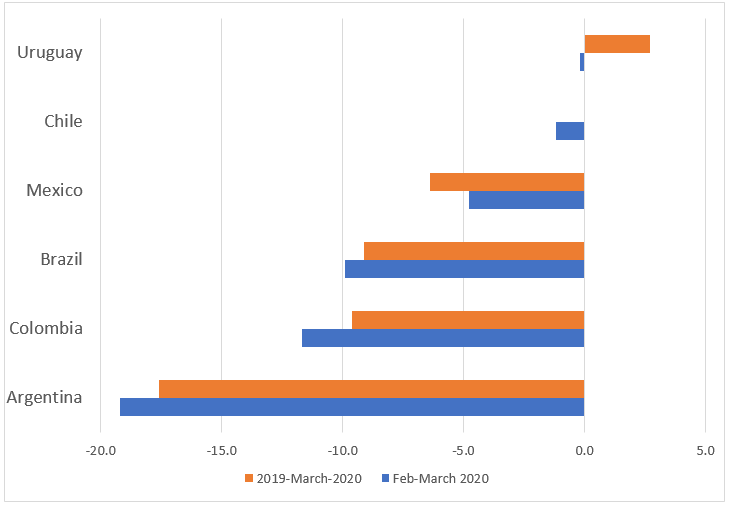

In terms of manufacturing, COVID-19 threatens to lengthen the lag between Latin America and the Caribbean and other regions (UNIDO 2018), in particular as a result of the considerable slowdown in Argentina, Brazil and Mexico, the region’s most industrially competitive economies. UNIDO figures for March show a 4.8 per cent drop in manufacturing output in Mexico compared with the previous month, while in Brazil, output in March sank by 9.9 per cent on the month. On a year-on-year basis, manufacturing output fell by 6.4 per cent and 9.1 per cent respectively in each country. In Argentina, manufacturing activity plummeted by 19.2 per cent in March alone.

Graph 1. Index of Industrial Production in selected countries March 2020, % change

Note: Base index 2015=100.

Source: UNIDO - Index of Industrial Production

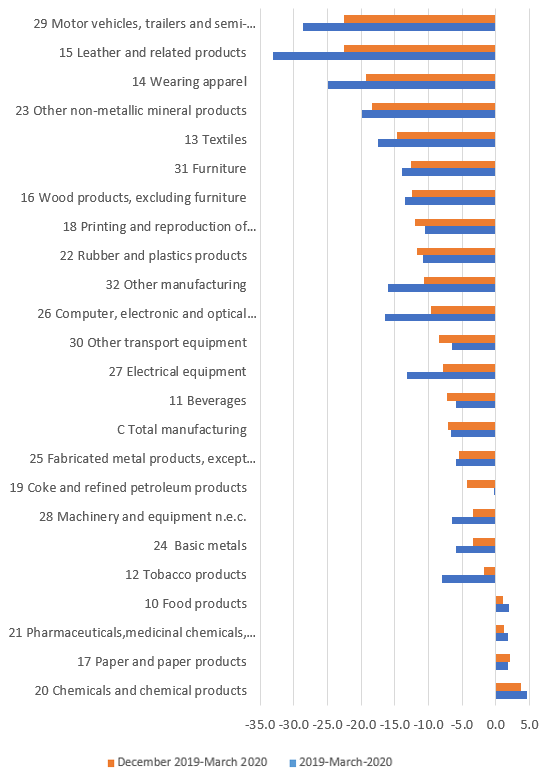

The available evidence indicates differences in impact between industries and countries across the region (Graph 2). However, the worst affected sectors across the board were automotive, leather products, textiles and clothing, and non-metallic minerals, whereas the production of chemicals, paper and paper products, pharmaceuticals and food products in March was up both on the year and compared to December 2019, reflecting efforts to keep supply chains open for essential items during the critical phase of the pandemic. These results were in keeping with impacts seen on a global scale. Production levels in industries related to leather, clothing, and vehicles, respectively, showed the greatest falls, while pharmaceutical products and food reported the greatest gains (Cantore et al 2020). Given the importance of the automotive industry to the region’s economies, in particular in Argentina, Brazil, Colombia and Mexico, and its high level of integration with global supply chains, there is extensive pressure to reopen this sector as soon as possible.

Graph 2: Index of Industrial Production by sector 2019-2020, % change

Note: Weighted average including Argentina, Brazil, Chile, Colombia, Mexico and Uruguay.

Source: UNIDO - Index of Industrial Production

Estimates on industrial performance available at the time of writing are likely to be adjusted downwards once national statistics offices in various countries release figures from April. Initial indications for April from Argentina, Brazil and Mexico already suggest dramatic falls in a number of indicators compared to March 2020.

The clear drop in manufacturing output is coupled with effects that will be less noticeable in the short term, but which are extremely important at a microeconomic level. These include a fall in industrial productivity resulting from at least two factors: i) the destruction of jobs and the consequent dismantling of company workforces whose in-depth knowledge of productive methods developed over time, together with their strategic linkages with other firms, will be hard to rebuild (Kellogg 2011); and ii) the loss of productivity gains resulting from innovation because investment in innovation tends to be procyclical, making it therefore likely that spending in R&D, already at chronically low levels, will drop further (Fabrizio & Tsolmon 2014).

At the same time, competitiveness could be affected by the rise in operating costs due to strict bio-security measures required by countries before manufacturing companies in the region can restart production. As a result of new requirements around hygiene, employee transportation and infrastructure, the maximum number of workers allowed in a shared space will be restricted, affecting productive capacity.

How to revive the sector

Various countries across the region are preparing to ease out of lockdown and start a gradual reopening of their economies. In this situation, the priority is to guarantee the health of workers and their families. From an economic standpoint, policies that target only the supply side will not be enough to ensure the transition to a new normality. They must be accompanied by measures to strengthen demand and boost the domestic market, as well as stemming the loss of employment and productive capacity among firms, in particular small and medium-sized enterprises (SMEs).

On the supply side

Countercyclical financing mechanisms for innovation: Innovation can help companies to develop new business models and to implement organizational changes so that they can better absorb shocks in the short term and guarantee viability and growth in the long term. In a region characterised by low levels of public support for innovation, it is particularly important to strengthen a portfolio of investment instruments combining the provision of matching grants with soft credits and “technological” guarantees, which reduce market risks associated with technological developments.

Encourage digitalization: Physical distancing rules imposed because of the pandemic place restrictions on financial transactions that require close contact between people. Switching to digital transactions for clients and suppliers, as well as inside firms, would diminish the impact of such restrictions. To serve the majority of companies, intervention is needed through major and standardized programmes that would allow them to improve their digital capacity, including methods of virtual training to facilitate the incorporation of initial digital applications (linked for example to transactions and electronic payment methods), technological extension programmes that support the digitalization of production processes, and a mass training programme to develop digital skills among the workforce (Navarro & Cathles 2019).

The challenge of digitalizing will vary according to the level of technological sophistication of each firm. Those with more technologically mature systems, and which are operating in countries with greater levels of industrial development, such as Argentina, Brazil and Mexico, can target a recovery strategy incorporating more advanced technologies such as those associated with Industry 4.0.

On the demand side

Stimulating domestic demand will be crucial given the uncertainty surrounding any recovery of demand at a global level, especially in the tourism and transport sectors, and given the disruption to global supply chains. Reviving industrial capacity on a more equitable basis can leverage on new state priorities, both regarding the handling of the health crisis and in creating conditions so that particular manufacturing activities can capitalize on recovery measures. Food, textiles, chemicals and medical equipment would face favourable conditions to meet new local demand. The state could incentivize the development of products and business models for the market through strategic public procurement to encourage innovation (Crespi 2017).

Public policies are also critical to reverse structural deficiencies regarding wealth distribution. UNIDO (2017) has shown that strengthening purchasing power in middle income segments of the economy is a powerful factor in stimulating domestic demand for new products, innovation and ultimately diversification, job creation and industrial development.

Building resilience for the long term

Latin America and the Caribbean is facing a challenge to quickly re-establish economic activity, safeguard the health of its populations and lay foundations to make its productive sector more resilient in the long term. Efforts to diversify export markets and link supply chains though investment in infrastructure and knowledge must include measures to build resilience to external events (Santiago et al 2020).

COVID-19 is an example of one such event in the area of health, but we should not forget other devastating effects in the region resulting from climate change, such as the growth in environmental impacts associated with el Niño climate phenomenon, like drought in Central America, Colombia, Mexico and Venezuela, torrential rain and flooding in Argentina, Chile and Peru, or the rise in frequency and intensity of forest fires in Brazil (Ferreiro 2015).

It is possible to introduce, and where relevant, expand mechanisms for cooperation that would allow countries in the region to present a united front against health and environmental emergencies that affect economies, exacerbate migration and hamper inter-regional security. It is therefore worth paying attention to and learning from two such initiatives already in place.

First is the Central American Integration System (SICA) Regional Contingency Plan to complement national action on health and provide a framework for collective action on the economy, security and communication within the Central American region (SICA 2020). Second, given the region’s limited scientific and technological capacity compared to other developing regions, is the recent and timely call from the IDB’s Institute for the Integration of Latin America and the Caribbean (IDB-INTAL) for research directed towards producing rapid diagnostics and proposals for specific action in areas such as trade and regional and global integration of Latin America and the Caribbean post-COVID-19 (IDB-INTAL 2020).

Initiatives of this kind are consistent with efforts to mobilize productive and technological capacities to deal with the COVID-19 emergency (Santiago et al 2020). They should serve as a source of inspiration for other regional cooperation initiatives to turn the pandemic into a defining moment in the pursuit of faster, equitable and sustainable development for the long term.