Coronavirus: the economic impact - 4 May 2020

17 June 2020 By the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

Originally Published on 28 March 2020. Sources were updated on 20 April and 04 May 2020.

By the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

Introduction

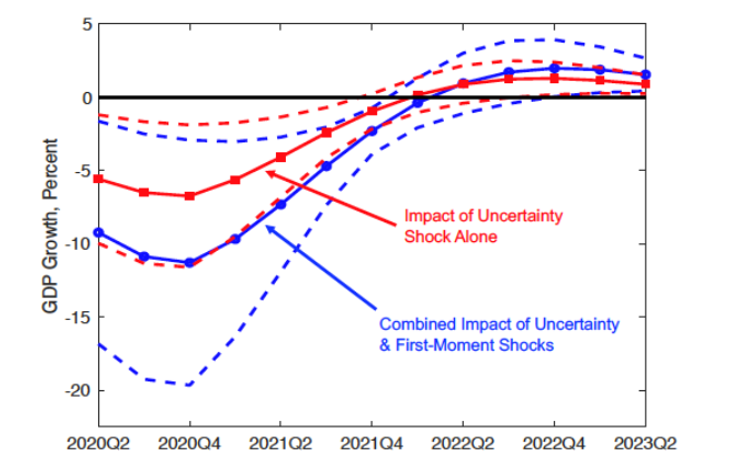

The factor of uncertainty afflicting the economic system and the capacity of decision makers to respond to the shock of the COVID-19 pandemic in a timely and effective manner is significant. A recent study published in VOX (Baker et al 2020), which analyses the U.S. economy, finds that COVID-19 will cause a substantial output contraction. Modelling simulations predict that over half of this contraction will be attributable to COVID-19-induced economic uncertainty with its impact on investment, the business environment, and higher transaction costs. The costs of uncertainty are comparable to those generated by the pandemic itself.

Figure 1: Estimated impact of COVID-19 on the U.S.’s real GDP growth rate

Source: Baker et al. (2020)

Policymakers have rarely faced such immense challenges in responding to the existing economic conditions. The following section briefly summarizes the economic impacts at the macro level with a focus on GDP, poverty and environmental forecasts. Section 2 reviews the most recent data on manufacturing production and trade, and the last section concludes and draws some policy implications.

Socio-economic impacts of the COVID-19 crisis

The projected impact of COVID-19 worsens every week

The accelerated spread of COVID-19 has brought the world economy to a standstill. Projections of the potential impacts of the COVID-19 shock on the global economy vary considerably. Yet there is near unanimous consensus that the world economy is facing the most serious challenge of the post-war era due to the sudden halt in economic activity in both advanced and developing countries.

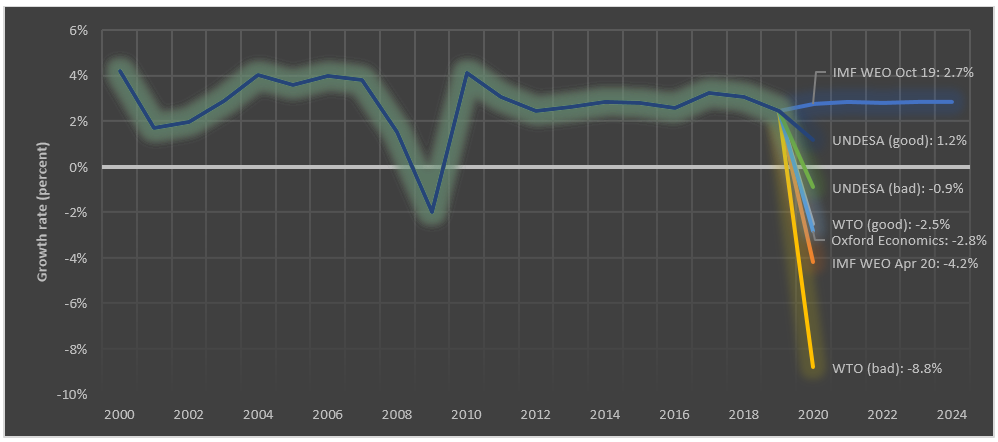

Containment measures are leading to further downward predictions of global GDP growth

In mid-April, the International Monetary Fund (IMF) updated its global growth projections and stressed that the global economy is expected to experience its worst recession since the Great Depression. The WTO’s latest forecasts are even worse, projecting a negative growth rate of nearly 9 per cent for 2020 in the worst-case scenario (Figure 2). Other projections conducted at the beginning of the month were more optimistic, such as that of the United Nations Department of Economic and Social Affairs (UNDESA): in the worst-case scenario, global GDP will contract by up to 1 per cent.

Figure 2: World growth outlook: latest projections by different organizations

Note: The projections are based on market exchange rates and were carried out on the following dates: IMF = 14 April; Oxford Economics = 14 April; UNDESA = 1 April; WTO = 9 April. UNDESA and WTO distinguish between two possible scenarios on the pandemic’s severity. The projections carried out by the IMF World Economic Outlook (WEO) 2019 (blue line) are used as the baseline for comparison.

Source: UNIDO elaboration based on Oxford Economics (2020), IMF (2019 and 2020), UNDESA (2020) and WTO (2020).

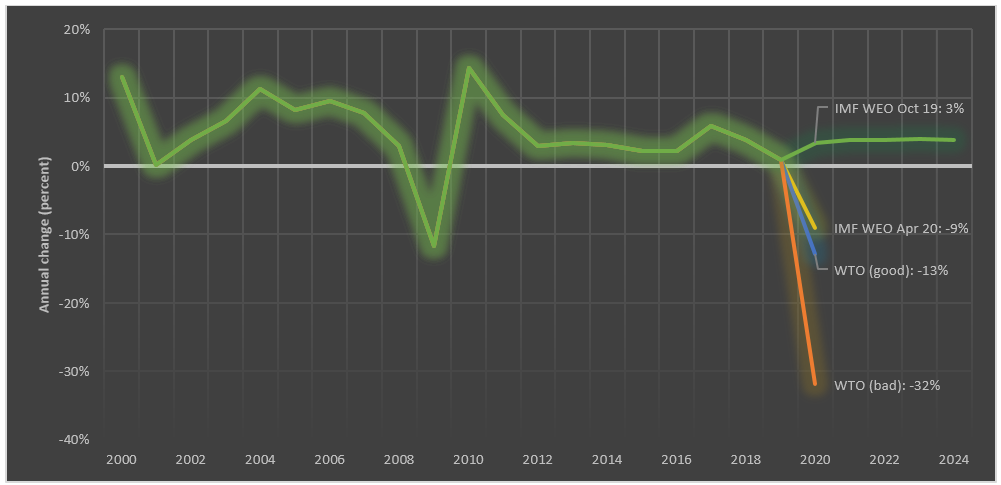

Trade and GVC disruptions are at the centre of the storm

The projections for the volume of trade of goods and services are even more dire. In the World Economic Outlook, the IMF revised its projections of growth in the trade of goods and services from an earlier estimated 3 per cent to -9 per cent. The WTO, which measures trade in terms of the average change in exports and imports of merchandise (excluding services), predicted a decline of between 13 per cent and 32 per cent (Figure 3).

Figure 3. Annual change in the volume of global trade: latest projections by different organizations

Note: Change in trade is calculated as the average in the change of exports and imports. WTO projections include only merchandise trade (excluding services). IMF figures include goods and services. The projections were carried out on the following dates: IMF = 14 April; WTO = 9 April. The projections carried out by the IMF in its World Economic Outlook (WEO) 2019 (green line) are used as the baseline for comparison.

Source: UNIDO elaboration based on IMF (2019, 2020a) and WTO (2020).

Capital flows are flooding back to advanced economies

Global foreign direct investment (FDI) is equally affected, and the weeks since the outbreak of the COVID-19 crisis went global have witnessed unprecedented outflows of capital from emerging economies. UNCTAD’s latest Global Investment Trend Monitor warns that FDI could experience downward pressure of between -30 per cent and -40 per cent in 2020–2021.

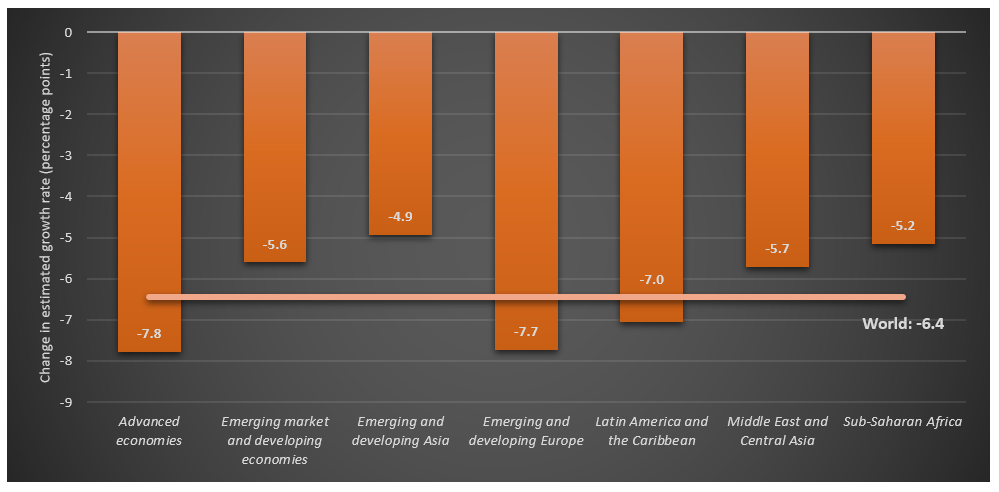

Within developing countries, Emerging Europe and LAC are expected to be the hardest hit

Different projections for economic growth in 2020 predict an overall contraction around the world, but some regional differences emerge. While advanced economies are expected to be hit hardest by the COVID-19 crisis, emerging and developing Europe and countries in Latin America and the Caribbean have seen the largest downward revision of GDP growth projections.

Figure 4. Regional differences of GDP growth rate projected for 2020 in the IMF’s WEO Oct 2019 and Apr 2020

Source: UNIDO elaboration based on IMF (2019, 2020a).

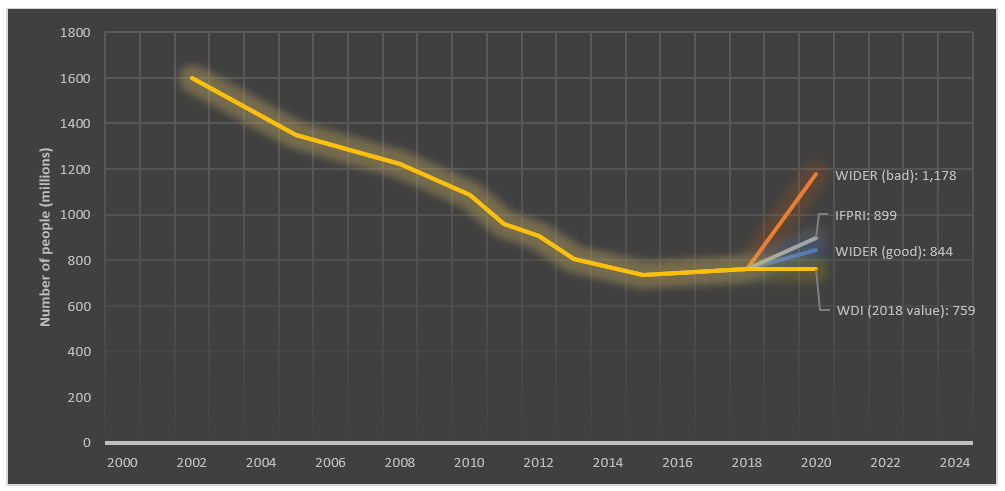

Global extreme poverty is expected to rise for the first time in decades

Researchers have attempted to estimate the impact of the COVID-19 crisis on global extreme poverty (Figure 5). These estimates produce a wide range of results. The expected increase of people living under the USD 1.90 PPP poverty line ranges from 85 million to 420 million. The latter figure represents an increase of over 50 per cent relative to the most recent figures from 2018. Despite the wide dispersion of results, all projections seem to indicate that global poverty is likely to increase for the first time since 1990.

Figure 5. Number of people below the US$ 1.90 PPP poverty line: latest projections by different organizations

Note: The projections were carried out on the following dates: Laborde et al. [IFPRI] = 16 April; Summer et al. [UNU-WIDER] = 8 April. The values of the World Bank’s WDI 2018 (yellow line) are used as the baseline for comparison.

Source: UNIDO elaboration based on Laborde et al. (2020), Summer et al. (2020) and World Bank WDI database.

The flip side to the halt in economic activities is an improvement in the environment

As the COVID-19 crisis continues to unfold, it also continues to cut energy demand and CO2 emission. A comprehensive study conducted by Carbon Brief estimates that the pandemic could cause CO2 emission cuts of around 2,000 million tonnes in 2020, equivalent to 5.5 per cent of total global CO2 emission in 2019 (Evans, 2020). If this is the case, the COVID-19 crisis would be responsible for the largest annual drop in global CO2 emission in history.

Impact on manufacturing production and trade in the first quarter of 2020

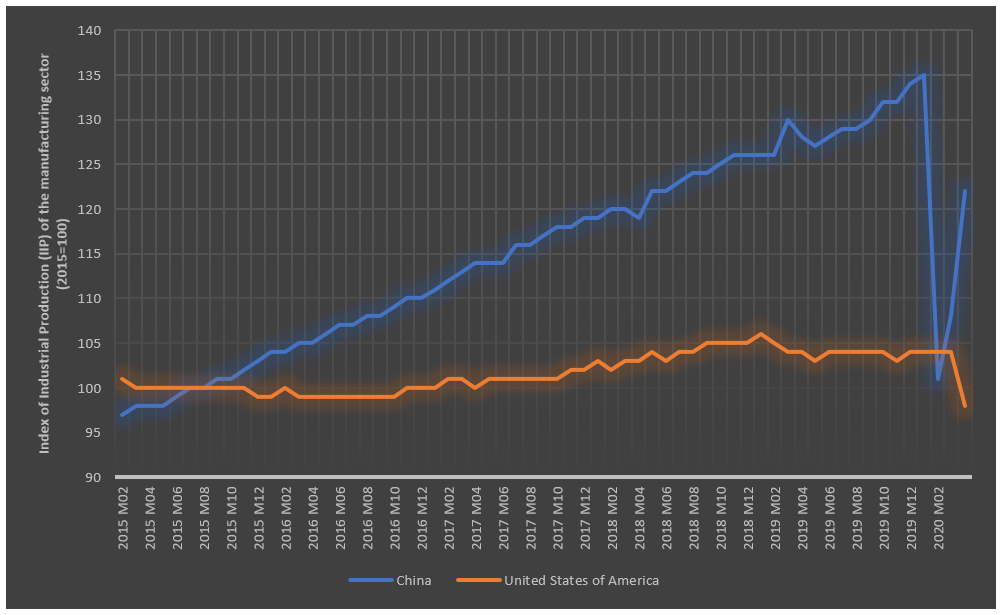

Beyond the economic projections for 2020, international organizations are starting to publish initial data on countries’ economic performance. The UNIDO database provides preliminary data on the index of industrial performance in January/February/March 2020 compared to December 2019, representing the pre-crisis period.

A snapshot of industrial production in March 2020 (vs December 2019): China recovering fast, the U.S. at a negative peak?

In February 2020, 24 out of 34 high-income and developing countries included in UNIDO’s COVID-19 database still registered an increase in industrial production compared to December 2019. China was hit hard by the crisis with a 20 per cent drop in industrial production following the country’s lockdown. The reduction in China’s export potential could be an important factor in the disruption of global value chains (Seric et al., 2020). However, in March 2020, China made a strong recovery, with only a 10 per cent reduction in industrial production compared to December 2019 (Figure 6). A rapid recovery of China and other heavily affected players could invalidate the most pessimistic projections and result in lower losses in other countries. In March 2020, industrial production in the United States dropped by 6 per cent (vs December 2019) after the lockdown was implemented (Figure 6).

Figure 6. Index of Industrial Production (IIP) of the manufacturing sector in China (a) and in the United States (b). 2015 = 100.

Heterogeneity of impacts across industries in the U.S. and China

By comparing the U.S. and China, an analysis of the Index of Industrial Production at industry level reveals a certain level of heterogeneity of the impacts across industries (March 2020 vs December 2019), depending on the economy’s structural composition and on the country-specific and international circumstances. The industries most affected in the U.S. are motor vehicles (-25 per cent), other transport equipment (-19 per cent), wearing apparel (-19 per cent), while in China they are other manufacturing (-23 per cent), furniture (-22 per cent) and leather (-14 per cent).

Trade data confirms strong impact of lockdown and containment measures

The findings of an analysis of OECD data on the trade of goods over the period December 2019 (pre-crisis) to March 2020 are similar to those obtained from industrial production data. By comparing data on the trade of goods from February 2020 and December 2019, 18 out of 35 countries still show a positive increase in overall exports, with only Finland (-25 per cent), Chile (-11 per cent) and Norway (-8 per cent) registering negative performances. Among a group of non-OECD countries including Argentina, Brazil, China, Colombia, Costa Rica, India, Indonesia, Russia and South Africa, only Argentina (-10 per cent) and Russia (-10 per cent) suffered losses. Data for March 2020 are only available for four countries, namely Argentina, Brazil, China and India. Brazil continues to show a positive increase in exports compared to the country’s December levels (+5 per cent), while India, Argentina and China recorded losses (30 per cent, 20 per cent and 5 per cent, respectively, compared to December 2019). The collapse of India’s exports can be explained by the lockdown adopted in March.

Policy and coping strategies

Governments urged to tailor their responses to the individual phases of the COVID-19 crisis

Most policy analyses in the current literature on the COVID-19 pandemic stress the importance of tailoring government responses to address each phase of the crisis individually, and to differentiate between short-, medium- and long-term targets and goals. Some variations, nonetheless, remain in the number of phases considered and the degree of detail of the policy responses within those phases.

Policy responses are revised in response to the deteriorating economic prospects triggered by the pandemic

As the pandemic’s epicentre shifted, first from China to Europe, then to the United States and the rest of the world, and the economic prospects deteriorate, governments across the world are increasingly resorting to economic policies in addition to containment measures already in place. Impact evaluation exercises focussing on specific regions have further highlighted that the current economic crisis is likely to exacerbate pre-existing weaknesses, unless adequate measures have effectively been put in place.

The international community must mobilize support for developing countries

Analyses focused on developing countries tend to agree that the economic stimulus necessary to mitigate the pandemic’s economic damage by and large exceeds the sums announced by governments so far, which further underpins the need for international cooperation (see, for instance, Jayaram et al. (2020) on African countries). The international community has certainly stepped up efforts.

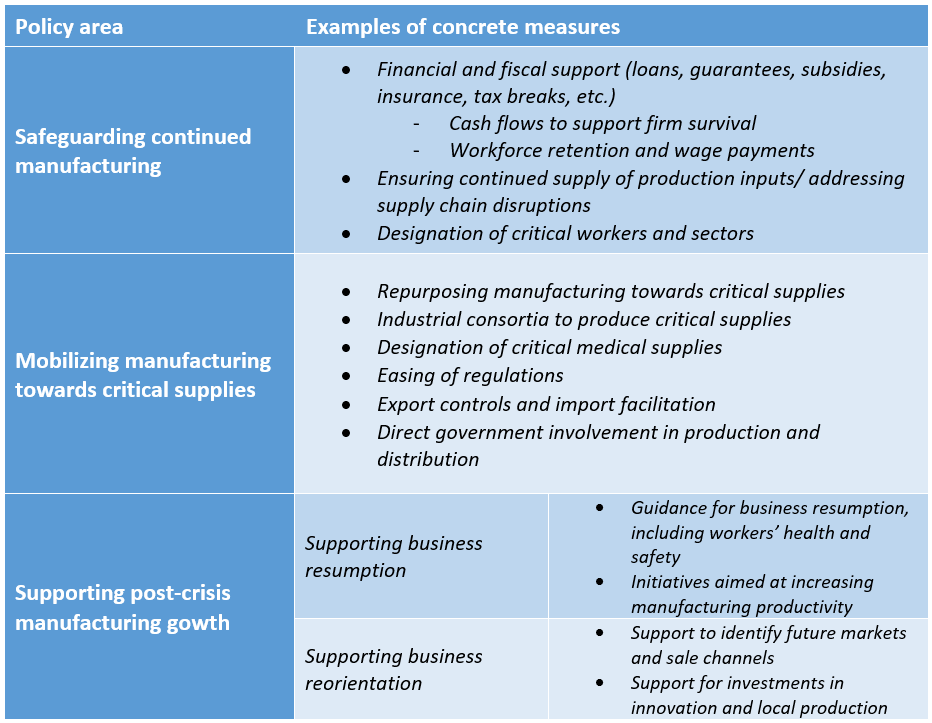

Policies to support manufacturing are emerging

A recent report prepared by the Policy Links Unit of the Cambridge University Institute for Manufacturing (IfM) reviewed policy responses aimed at mitigating the potential impacts of COVID-19 on manufacturing in 11 countries, plus the European Union. Their study indicates that while macroeconomic mitigation measures are likely to impact the manufacturing industry, they are often combined with emerging measures in three distinct areas: (1) safeguarding continued operation of manufacturing; (2) mobilizing manufacturing towards critical supplies; and (3) supporting post-crisis manufacturing growth. Table 1 provides examples of concrete measures taken in each of these areas so far.

Table 1. Current international policies and measures to support manufacturing

Note: Policies taken by central/national governments in Australia, China, France, Germany, India, Italy, Japan, Rep. of Korea, New Zealand, Singapore, the United States and the European Union as of 3 April 2020 are presented. The list of concrete measures combines newly established measures and previously existing ones that have been expanded and/or repurposed. It is non-exhaustive and measures may not be exclusive to the manufacturing industry, but also benefit other sectors.

Source: UNIDO based on Castaneda-Navarrete et al.(2020).

Table 1 above includes measures that could be intensified in the mid- to later stages of the recovery phase with a view to shaping a new future for the manufacturing industry (i.e. government support to identify emerging markets and consumer needs, as well as direct funding to promote the internalization of production and the creation of new supplier networks) as explained by Hartwich et al., 2020.

Cross-sectoral policies and measures will likely impact the manufacturing industry, but uncertainty remains as to how specific sectors will be affected

In its sectoral briefs series, the ILO discusses the likely impact of macroeconomic policies and other cross-sectoral measures on industries, noting, however, that it is still too soon to fully grasp how many of the current policy responses will effectively impact specific sectors. The biggest uncertainties identified are “whether and how SMEs in the supply chains will be able to access financial assistance, and whether major producing countries will be able to benefit from their implementation” (p. 4).

Repurposing efforts can help tackle COVID-19 and save jobs but entails challenges that need to be overcome

Business efforts to retool factories so traditional production lines can incorporate products for which demand is increasing (i.e. ventilators, masks and protective gowns) are underway in advanced economies and have started to emerge in the developing world (e.g. an apparel factory in Kenya shifted to producing masks within one week and is now producing 30,000 masks per day) (Jayaram et al., 2020). Such efforts can simultaneously help address the health emergency and retain jobs.

Trade policies could enable access to critical supplies and mitigate the effects of disruptions in global value chains

In light of the challenges for local production and the current surge in protectionist measures, the recent literature on policy responses to the coronavirus pandemic emphasizes the importance of trade measures to keep supply chains and international commerce running, especially of medical supplies. According to UNCTAD, this recognition is reflected in increased funding for international organizations to support trade facilitation efforts, which are deemed key to the implementation of the WTO’s Trade Facilitation Agreement (TFA).

Joint efforts could help pave the way towards a better future

In a recent statement, UN Secretary General Guterres urged civil society, governments, businesses and international organizations to join efforts to turn the recovery from an ongoing health crisis into a real opportunity to build a better, greener future (United Nations, 2020). City, state and national leaders are elaborating COVID-19 recovery plans that could also generate benefits for climate change mitigation and resilience, racial, gender and economic equity.

Disclaimer: This brief provides information about a situation that is rapidly evolving. As the circumstances and impacts of the COVID-19 pandemic are continuously changing, the interpretation of the information presented here may also have to be adjusted in terms of relevance, accuracy and completeness. The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

Original release: “Coronavirus: the economic impact", released on 28 March 2020.