The COVID-19 pandemic and the call for innovation policies in the health sector

19 October 2021 Julia Paranhos, associate professor at the Economics Institute, Federal University of Rio de Janeiro (IE/UFRJ), Brazil

By Julia Paranhos, associate professor at the Economics Institute, Federal University of Rio de Janeiro (IE/UFRJ), Brazil. She is also the coordinator of the Economics of Innovation Research Group at IE/UFRJ

and

Fernanda Steiner Perin, Lecturer in Economics at Birmingham City University, UK, and an associate researcher at the Economics of Innovation Research Group at IE/UFRJ

- This opinion piece is part of a series of articles commissioned by UNIDO's Department of Policy Research and Statistics. The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

Innovation-driven growth is indispensable for addressing the tremendous social, environmental and economic challenges both developed and developing countries face in the 21st century (Mazzucato, 2018). Innovation has played a key role in transforming the position of developing countries in the international division of labour, and is a priority in the national strategies of countries that have successfully managed to catch up with developed countries (Cimoli et al., 2009; Dahlman, 2009; Lee & Malerba, 2017). The COVID-19 pandemic has compounded the challenges of the 21st century and demonstrated that countries with a manufacturing sector capable of responding quickly and successfully to mitigate the pandemic’s adverse effects had long-term industrial and science, technology and innovation (STI) policies in place, including for the pharmaceutical industry. This group of countries includes the United Kingdom, the United States, China and India.[1]

When implemented properly, innovation policy modifies a country’s economic structures and the institutions involved in developing, disseminating and applying knowledge, ultimately leading to economic growth (Lee & Malerba, 2017; Lundvall et al., 2009). To achieve economic development, innovation policies must be integrated in a systemic framework; moreover, innovation policies must be driven by a long-term strategic perspective, far beyond the momentary market signals, to create and sustain economic growth based on the development of manufacturing firms’ productive and innovative capacities (Edquist, 2005; Freeman, 2004). Such systemic policies should not only focus on resolving the failures (or problems) within the innovation system, but should assume a more proactive role, with the state taking the lead and the manufacturing sector following to co-create new markets (Mazzucato, 2018). That is, the state should be responsible for creating value and for orchestrating the pace and direction of innovation so new products, processes and services can meet society’s needs (public and individual) (Kattel & Mazzucato, 2018).

Setting the direction of health innovation to pursue the “public health value” involves choosing missions, selecting priority health areas and identifying unmet health needs that require new treatment options. The public sector should provide long-term financing but must also introduce and promote incentives to attract and leverage long-term private investments. Such financing must be aligned with public health needs and the reduction of business risks (Edquist, 2019; Kattel & Mazzucato, 2018; Mazzucato & Roy, 2019).

The crucial role of sustained industrial and STI policies for the pharmaceutical industry

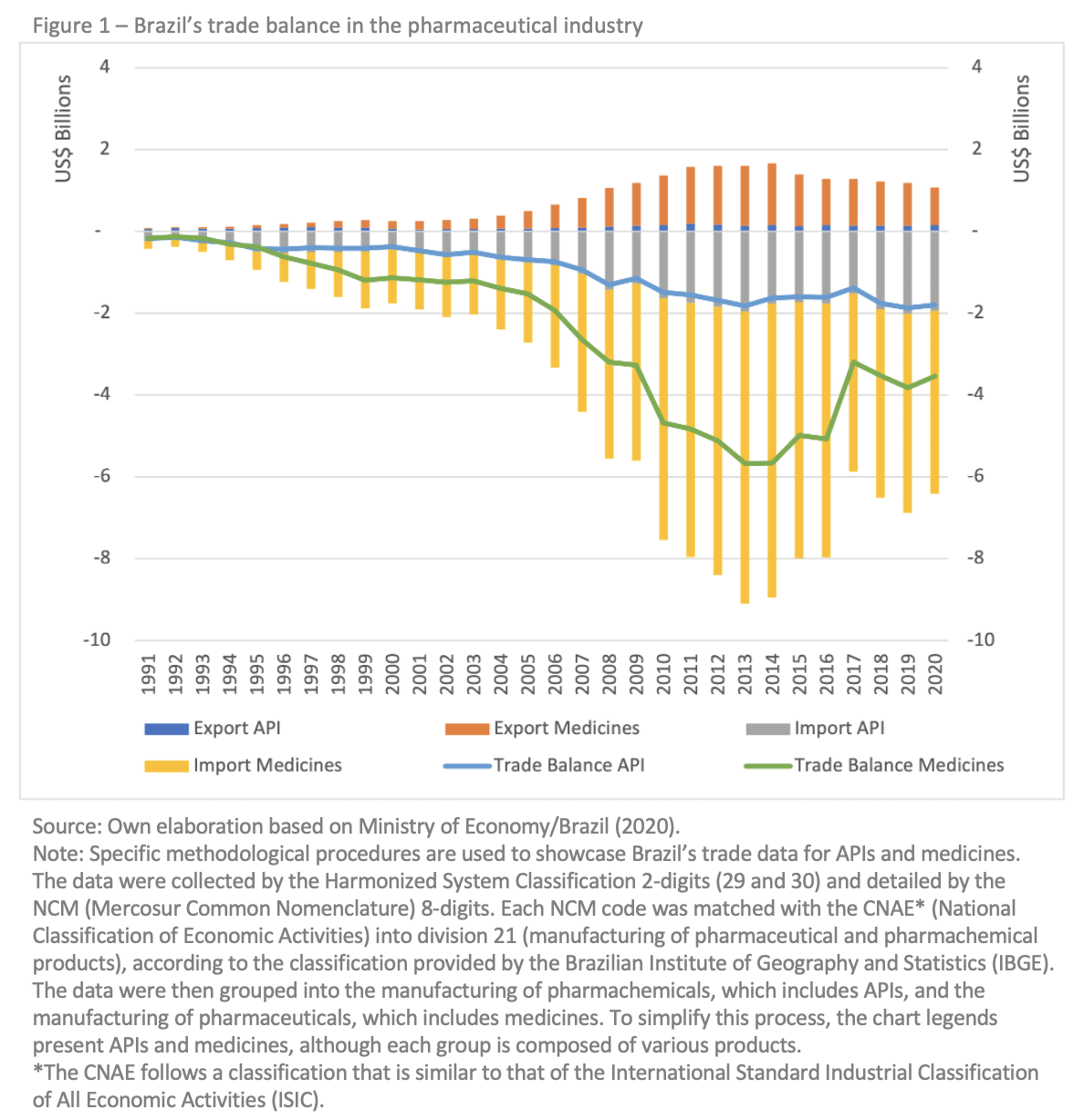

We use the case of Brazil to illustrate the importance of sustained industrial and STI policies for innovation-driven growth in the health sector, particularly in developing countries. The global interdependence of the pharmaceutical market and the global dependence on active pharmaceutical ingredients (API)—inputs needed to produce medicines and vaccines—from China and India became vividly clear during the pandemic. The dependence of Brazil’s pharmaceutical industry in this regard has intensified since the country’s economic opening in the early 1990s. As shown in Figure 1, the deficit of Brazil’s pharmaceutical industry has increased since the 1990s and became a structural problem. Most of the country’s imports consist of finished products, including medicines. API imports increased four-fold between 2003 and 2020, amounting to around USD 2 billion per year.

When looking at the history of industrial and STI policies in Brazil, we find that the government prioritized the pharmaceutical industry from 2003 to 2016, introducing three major industrial and three STI policies specifically targeting the industry. The Brazilian government systematically promoted manufacturing and innovative activities in the health sector during this period by matching supply and demand actors within the Health Industrial Complex (CIS) and guiding their development. It aimed to align industrial and STI policies with health policies to strengthen local production and reduce external dependence.

We focus on three of the public policy programmes and instruments launched during this period. First, the Programme to Support the Development of the Pharmaceutical Productive Chain (Profarma) was introduced by the Brazilian Development Bank (BNDES) in 2004 to provide loans with special interest rates and improved payment conditions for innovation projects. The second instrument was the Subvenção Econômica Programme, managed by the Brazilian Innovation Agency (FINEP) since 2006, initially offering non-reimbursable resources for firms, and later integrated into the Inova Saúde Programme in 2013, which combined reimbursable and non-reimbursable resources for firms. Finally, the third instrument was the Productive Development Partnerships (PDPs) which were introduced by the Ministry of Health in 2008. Public procurement was used to promote local production to supply the Unified Health System (SUS). The PDPs acquired products listed as strategic to SUS that had been manufactured domestically by public-private partnerships and transferred the new technologies and pharmaceutical products to local firms.

Between 2004 and 2018, the Subvenção Econômica, Inova Saúde and Profarma financed a total of 298 projects in 142 national pharmaceutical firms, totalling USD 1.6 billion (BRL 8.3 billion[2]). Of these firms, 11 also participated in PDPs, which is an indirect articulation of the public policy instruments introduced by the Brazilian government (Paranhos et al., 2021).

Public policy impacts on Brazil’s pharmaceutical industry

The Brazilian pharmaceutical industry partially responded to the policies adopted by the government between 2003 and 2016 and they are an exception in the face of declining industrial production (Nassif & Castilho, 2020). The revenues of Brazil’s pharmaceutical companies in 2017 amounted to USD 13.9 billion (BRL 70 billion), with the share of national companies increasing. The number of large national pharmaceutical firms along with their product portfolios grew as well; five national pharmaceutical firms were among the top ten in the Brazilian market in 2017 compared to only one in the early 2000s (ANVISA, 2018).

During that period, Brazil’s national pharmaceutical firms witnessed strong growth. The expansion of their manufacturing resources focused primarily on the development of generic drugs, and later national companies entered in the production of biological drugs (biossimilars) stimulated by PDPs agreements. An attempt, albeit incipient, was also made to link industrial manufacturing with health demand. The two largest public pharmaceutical firms (or public pharmaceutical laboratories as they are referred to in Brazil), Biomanguinhos/Fiocruz and Butantan, were key actors in PDPs for biological products and successfully increased their overall manufacturing capacity. They were therefore able to conclude agreements on the local production of COVID-19 vaccines.

Despite these achievements, Brazil’s pharmaceutical industry continues to be afflicted by unresolved deficiencies and structural problems. The country’s national pharmaceutical firms still lag far behind the dynamic pharmaceutical firms currently operating at the global level, although Brazil has made significant strides in terms of regulatory compliance (good manufacturing practice – GMP), local production and participation in the generic pharmaceutical market based on API imports (see Figure 1). However, the innovation results were concentrated in a small number of large firms. The pharmaceutical industry’s value added grew by 3 per cent annually, on average, between 2000 and 2019, but its share of value added in gross production value has fallen from 60.7 per cent to 55.9 per cent over the last 20 years (IBGE, 2019). The performance is particularly negative when it comes to a technology intensive industry. Only 40.6 per cent of pharmaceutical firms in Brazil have recently implemented product or process innovation (IBGE, 2020).

The Brazilian government did not design a specific programme or instrument to promote the API industry. The pharmaceutical industry’s output increased but was based on imported inputs, representing 45.5 per cent of its total inputs used– the largest share among all manufacturing industries in Brazil (CNI, 2019). The API industry faces fierce price competition, and therefore does not automatically expand as a result of the pharmaceutical industry’s growth. The participation of Brazil’s API industry in supplying local pharmaceutical firms declined amidst strong competition from Chinese and Indian imports. The global pharmaceutical industry is made up of large enterprises that operate in markets around the world, make high investments in research and development (R&D) as well as marketing, and have a strong manufacturing structure and distribution channels. To participate in this global market, Brazil’s burgeoning local industry needs to be strengthened based on policy measures driven by a long-term perspective, as have been introduced in India, China and the Republic of Korea.

The Brazilian government prioritized the national pharmaceutical industry and fostered local production for 13 years by introducing strategic industrial and STI policies, but no notable achievements were made in terms of innovation or the reduction of external dependency. The government suspended the policy initiatives introduced for the pharmaceutical industry in 2016. Although BNDES financing is still available, it is not aligned to the pharmaceutical industry’s particularities. PDPs face immense legal uncertainty and FINEP is fighting for survival. The Executive Group of the Health Industrial Complex (GECIS), which used to play a central role in identifying and matching actors and in proposing public procurement for pharmaceutical firms to promote local production under the guidance of the Ministry of Health, became defunct in 2019. Continued and sustained industrial and STI policies will be necessary if Brazil’s pharmaceutical industry is to grow and succeed.

When the COVID-19 pandemic broke out, BNDES launched the Programme of Emergency Support for Combating the Coronavirus Pandemic and provided financial assistance to firms. The budget set aside for such assistance amounted to USD 396 million (BRL 2 billion), with the aim of increasing the supply of medical and hospital equipment without delay. In addition, FINEP launched three subsidy schemes to support innovative solutions in the fight against COVID-19, one public tender for the laboratory infrastructure projects, as well as the COVID-19 Emergency Actions Programme with reimbursable resources, totalling USD 65.5 million (BRL 331 million). These instruments are being implemented ad hoc, with the sole objective of addressing the most pressing problems and are not part of a long-term strategy by the government to strengthen Brazil’s pharmaceutical industry.

The path forward for Brazil’s pharmaceutical industry

To bolster Brazil’s pharmaceutical industry, we propose a resumption of negotiations with a focus on rebuilding the state capacity to shape the direction of innovation and equitably disseminate its benefits. Industrial and STI policies open up the possibility to transform manufacturing structures (Santiago, 2020), to determine the future trajectory of capabilities accumulation and the patterns of productivity and trade.

These policies and actions must be aligned with the population’s health needs to ensure that the public funds are invested in projects with economic and social returns (Torreele et al., 2021). This also requires close collaboration with the Ministry of Health to clearly define priorities.

Public policies should further promote the innovative capacity of national firms, focusing on more complex and robust innovation projects. It is therefore crucial to create new instruments for financing high-risk and uncertain innovative activities aimed at meeting public health needs. Non-reimbursable resources and public procurement are recognised as instruments to direct innovative projects to the public interest.

Finally, the importance of monitoring and evaluation when formulating industrial and STI policies and instruments cannot be overemphasized. The monitoring of policies targeted at public health needs is essential, while evaluation mechanisms assess the instruments’ and measures’ effectiveness in achieving the social and economic objectives and policy goals.

The COVID-19 crisis has demonstrated that countries’ domestic capacity to develop and produce vaccines and medicines makes all the difference during a health crisis. Recovery from the pandemic will require a review of the growth model adopted in recent years and additional support for strategic industries for the benefit of society as a whole. As the case of Brazil demonstrates, the government’s past industrial and STI policies were effective in increasing the manufacturing capacities of national pharmaceutical firms. Clearly defined, sustained and long-term policies are necessary to limit the risks associated with innovative activities that focus on the weakest links and unmet health needs. The COVID-19 pandemic has taught us that sustained innovation policies aligned with public health needs are crucial to create productive and innovative capacities to meet unmet demands.

- Note: It is now abundantly clear that the COVID-19 pandemic has had an impact on nearly all aspects of our lives and has caused us to rethink “business as usual”. As we adapt to the "new normal", appropriately channeled opportunities can help us improve the way we do business and the way we live. The United Nations Industrial Development Organization is preparing its latest flagship report, the Industrial Development Report 2022, which will provide a comprehensive assessment of the pandemic’s impact on global manufacturing and the prospects for the future of industrialization in a post-pandemic world. Scheduled to be launched on 1 December 2021, the report will make a key contribution to countries' national and international strategies for an inclusive, sustainable and resilient industrial recovery to build back better from the COVID-19 pandemic.

[1] Despite the difficulties the Indian government encountered in containing the pandemic during the second wave of COVID-19 in the country, it is the world’s largest producer of vaccines, led by the Serum Institute of India (SII) and Bharat Biotech International Limited (BBIL) (WHO, 2020).

[2] Currency exchange BRL/USD = 5.04 (02 July 21).

References

ANVISA. (2018). Anuário Estatístico do Mercado Farmacêutico—2017. https://www.gov.br/anvisa/pt-br/centraisdeconteudo/publicacoes/medicamentos/cmed/anuario-estatistico-do-mercado-farmaceutico-2017.pdf/view

Cimoli, M., Dosi, G., Nelson, R., & Stiglitz, J. E. (2009). Institutions and Policies Shaping Industrial Development: An Introductory Note. In Industrial Policy and Development. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199235261.003.0002

CNI. (2019). Indicadores CNI: Coeficientes de Abertura Comercial. CNI. https://static.portaldaindustria.com.br/media/filer_public/1a/10/1a10608b-0dc1-40b1-abf6-3d2d0eeb4133/coeficientesdeaberturacomercial_serie-recente_precosconstantes_numero1_2019_v1.xlsx

Dahlman, C. J. (2009). Growth and Development in China and India: The Role of Industrial and Innovation Policy in Rapid Catch‐Up. In Industrial Policy and Development. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199235261.003.0012

Edquist, C. (2005). Systems of Innovation: Perspectives and Challenges. In Oxford Handbook of Innovation (pp. 181–208). Oxford University Press.

Edquist, C. (2019). Towards a holistic innovation policy: Can the Swedish National Innovation Council (NIC) be a role model? Research Policy, 48(4), 869–879. https://doi.org/10.1016/j.respol.2018.10.008

Freeman, C. (2004). Technological infrastructure and international competitiveness. Industrial and Corporate Change, 13(3), 541–569.

IBGE. (2019). Pesquisa Industrial Anual—Empresa. IBGE. https://sidra.ibge.gov.br/pesquisa/pia-empresa/quadros/brasil/2019

IBGE. (2020). Pesquisa de Inovação—2017. IBGE. https://sidra.ibge.gov.br/pesquisa/pintec

Kattel, R., & Mazzucato, M. (2018). Mission-oriented innovation policy and dynamic capabilities in the public sector. Industrial and Corporate Change, 27(5), 787–801. https://doi.org/10.1093/icc/dty032

Lee, K., & Malerba, F. (2017). Catch-up cycles and changes in industrial leadership:Windows of opportunity and responses of firms and countries in the evolution of sectoral systems. Research Policy, 46(2), 338–351. https://doi.org/10.1016/j.respol.2016.09.006

Lundvall, Vang, J., Joseph, K. J., & Chaminade, C. (2009). Innovation System Research and Developing Countries. In Handbook of Innovation Systems and Developing Countries (p. 416). https://www.e-elgar.com/shop/gbp/handbook-of-innovation-systems-and-developing-countries-9781847206091.html

Mazzucato, M. (2018). The Entrepreneurial State: Debunking Public vs. Private Sector Myths (1st edition). Penguin.

Mazzucato, M., & Roy, V. (2019). Rethinking value in health innovation: From mystifications towards prescriptions. Journal of Economic Policy Reform, 22(2), 101–119. https://doi.org/10.1080/17487870.2018.1509712

Ministry of Economy/Brazil. (2020). Exports and Imports Dataset [Dataset]. Comex Stat. http://comexstat.mdic.gov.br/pt/home

Nassif, A., & Castilho, M. R. (2020). Trade patterns in a globalised world: Brazil as a case of regressive specialisation. Cambridge Journal of Economics, 44(3), 671–701. https://doi.org/10.1093/cje/bez069

Paranhos, J., Perin, F. S., Vaz, M., Falcão, D., & Hasenclever, L. (2021). Articulação de políticas e instrumentos de produção e inovação para o Complexo Industrial da Saúde no Brasil, 2003-2017: Os casos do Inova Saúde e do Profarma (p. 147) [Partial research report]. Federal University of Rio de Janeiro/Open Society Foundations.

Santiago, F. (2020). Turning health challenges into industrialization opportunities for developing countries [Opinion Piece]. UNIDO - Industrial Analytics Platform. https://iap.unido.org/articles/turning-health-challenges-industrialization-opportunities-developing-countries

Torreele, E., Kazatchkine, M., & Mazzucato, M. (2021, April 1). Preparing for the next pandemic requires public health focused industrial policy [Opinion Piece]. The BMJ. https://blogs.bmj.com/bmj/2021/04/01/preparing-for-the-next-pandemic-requires-public-health-focused-industrial-policy/

WHO. (2020). Global Vaccine Market Report 2020. https://www.who.int/publications/m/item/2020-who-global-vaccine-market-report